Margin call formula

Using the margin call formula above he gets. Some tradersinvestors borrow funds from a broker for investments.

Simple Wedding Budget Worksheet Printable And Editable For Etsy Wedding Budget Template Wedding Budget Spreadsheet Wedding Budget Worksheet

This means that some or all of your 80 lot position will immediately be closed at the current market price.

. Calculating the Usable Margin or Free Margin that will be available after placing a trade can be done by using some simple arithmetic. The definition of a margin call is when an investor buys stock on margin and that stock decreases in value to a certain degree then. Using the above formula we get.

Free Margin and Used Margin Calculation Formula. To satisfy a margin call the in. Rates subject to change.

Margin Call is made when. Let say the investor purchase 100 stock at 40 per share it means he uses all his money and marginal all. Based on the policy the investor has to maintain a margin of 30.

A margin call occurs when the value of a margin account falls below the accounts maintenance margin requirement. In a margin account a margin call can occur when the value of the account drops to a certain level triggering a margin call. Read about examples of the margin call and see how to avoid it.

A maintenance margin is the minimum amount of equity that must be maintained in a margin account. A opens a marginal account with 2000 in cash and another marginal call of 2000 which is borrowed from the broker. Assuming a 50 initial margin and 25 maintenance margin we can enter our numbers into the margin call price formula.

Borrowing money on margin is called using leverage. Joe buys 100 worth of stocks of a company with a 50 initial margin and a 30 maintenance margin. The broker loans the funds at a certain interest rate.

A margin call is a demand by a brokerage firm to bring the margin accounts balance up to the minimum maintenance margin requirement. With the help of the margin call formula discover how to calculate the margin call. Margin Call Price.

Heres how to calculate a margin call. We offer the most comprehensive and easy to understand video lectures for CFA and FRM Programs. He uses 50 in cash and borrows the remaining 50 from a stockbroker.

Margin Call Price 120000 1 50 1 25 Margin Call Price 80000. He asks a broker to open a margin account in which his equity or. Margin Call Debt.

Heres the used margin calculation formula. Once your equity drops below 8000 you will have a Margin Call. In the context of the NYSE and FINRA after an investor has bought securities.

The easy to use online Margin Call Calculator makes it easy to learn how to calculate margin calls for your portfolio with just a few key presses. Margin call amount Value of investments multiplied by the percentage margin requirement minus Amount of investor equity left in margin account Heres the formula using the hypothetical investor example above. To know more about our video lecture series visit us at www.

Margin Call Formula. Therefore your account value must remain above 80000 at all times otherwise you are at risk of receiving a margin call. Your Used Margin will remain at 8000.

Margin rates as low as 283. 500 6000 x 025 1000. Clearly once we have the initial margin and maintenance margin percentages it is very easy to determine the price at which we can expect to get a margin call from the broker.

A margin call is a broker s demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin. Assuming you bought all 80 lots at the same price a Margin Call will trigger if your trade moves 25 pips against you. Jordan wants to invest in a security that has a market value of 50000.

What is the margin call price. Answer 1 of 3. Note that in the case of a short sale the investor also posts margin equal to a percentage.

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Market Value of Invested Securities Brokers Invested Cash Market Value of Invested Securities Maintenance Margin specified by the broker. Using leverage is a double-edged sword.

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Fernando Gonzalez Y Lozano Fgyl Broker Finances Stocks Exchange Markets Dividends Currencies Commod Investment Quotes Calling Quotes Personality Quotes

Supply Chain And Logistics Kpi Dashboard Dynamic Reporting Etsy Kpi Dashboard Supply Chain Logistics Interactive Charts

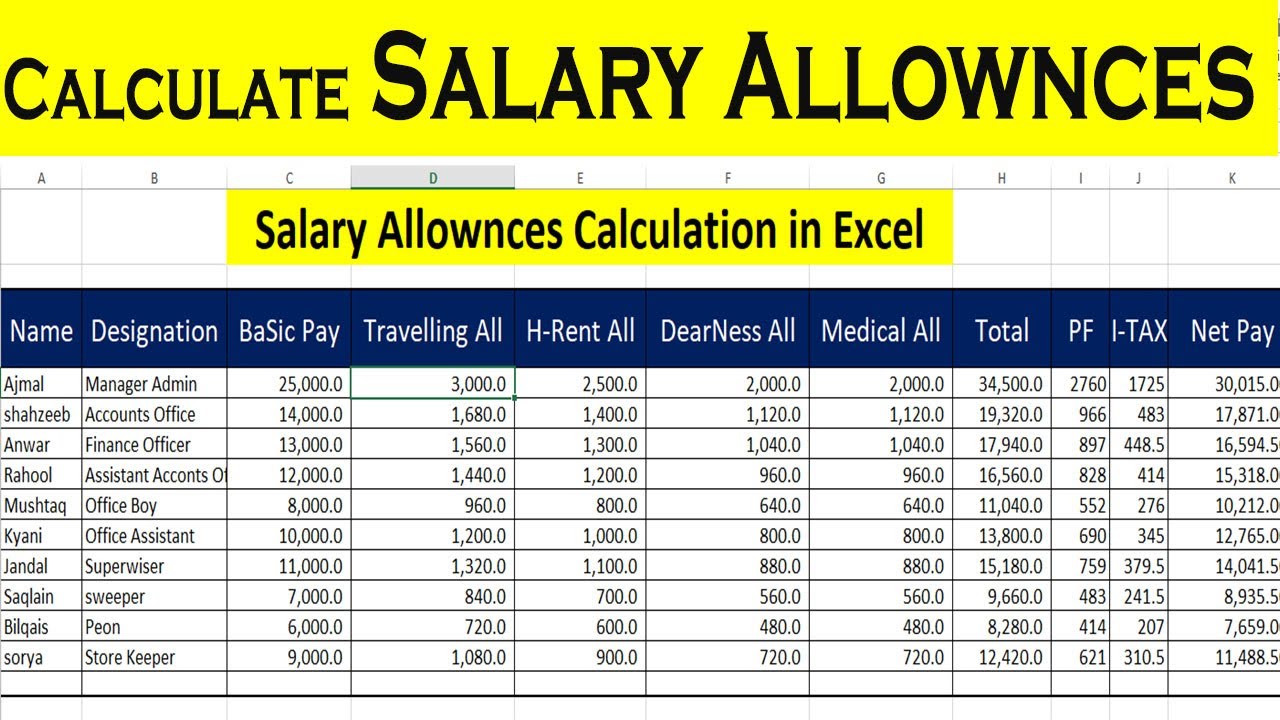

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Learning Centers Tax Deductions Excel

Quickbooks Support To Deal With Chart Of Accounts Quickbooks Chart Of Accounts Accounting Basics

What Caused The Stock Market Crash Of 1929 A History Stock Market Crash Stock Market Stock Market Investing

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Financial Analysis

Learn To Monitor Your Net Profit Margin With Management Kpis Management Kpi Key Performance Indicators

Financial Ratio Inventory Number Of Days While The Inventory Turnover Ratio Gives A Sense Of How Many Times The C Inventory Turnover Financial Ratio Financial

Calculate The Risk Of Margin Call Using An Statistic Formula Probability Calculator System

Updates To The Approach To Rheumatic Disease Rheumatic Diseases Synovial Fluid Gout

Journal Entry Of Interest Received In Cash Class 11 Book Keeping And Accountancy Journal Entries Journal Golden Rule

J5ip5cqqh2jlm

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Different Symbols Of Statistics Statistics Math Statistics Symbols Ap Statistics

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit